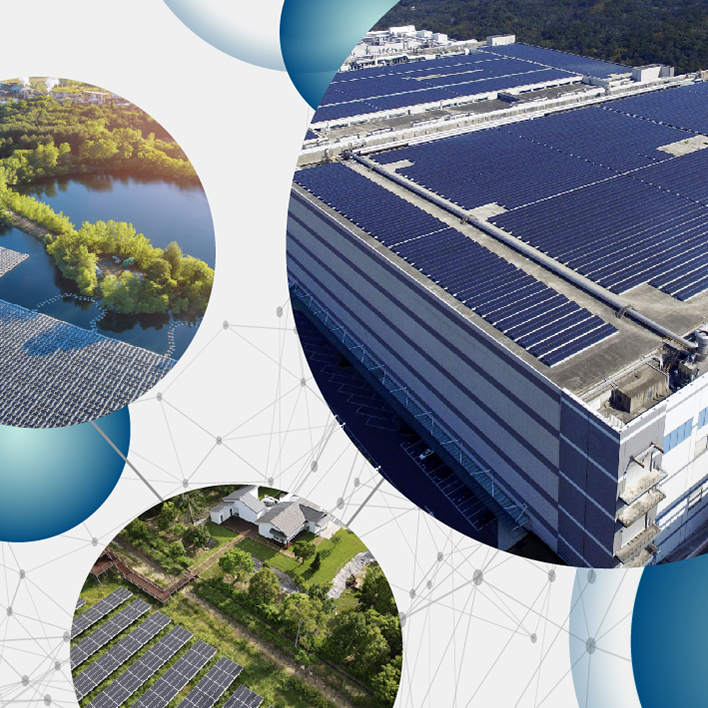

Smart Vertical Solutions for Limitless Possibilities

By integration of technical expertise and market insights, we provide our partners with access to smart solutions that stride beyond today’s cutting edge for new opportunities in retail, education, enterprise, healthcare, mobility, manufacturing, and energy sectors.

Technical Expertise

Our Advantages

We provide technical expertise and diversified solutions to open up new opportunities for our partners. We drive mutual success to attain the shared vision by our competences in flexible manufacturing, sustainable supply chain, global operation, and group synergy.

14

Years for DJSI Inclusion

Top

100

Clarivate Innovators & LexisNexis Innovation Momentum Inclusion

32,000

Submitted Patent Applications

Events & Highlights

-

Learn how we shape the future with our innovations and smart solutionsWant to know more? We are here to help!